People have different reasons to apply for financial assistance. Some want to borrow money so they can pay overdue bills or cover taxes. Some people, on the other hand, apply for loans to finance their homes or cars. Some companies even get financing to cover their operating costs during times of shortage.

College students also apply for loans to fund their education. As financial needs may vary from person to person, lenders and banks have provided different types of loans to help those who need financial assistance.

Different Types of Loans

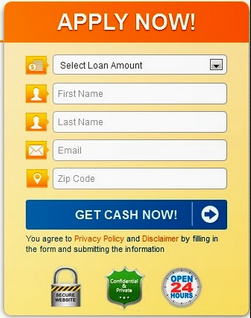

Payday: This short-term, unsecured financing allows you to get cash advance and pay the debt on your next payday. You can also write post-dated personal checks you can present to the lender. The lender will then present documents that specify the terms, interest rates, late fees, and other charges you need to cover for the loan. Although many people choose payday loans, the interest rate for this financing is higher than other types.

Business loans are available from banks. These institutions set terms, interest rates, and repayment schedule that can suit your business requirements. Some banks may offer different types of financial assistance, which may include secured and unsecured financing.

Nonetheless, banks conduct thorough evaluation to make sure your company is qualified to get financing. In closed-end loans, lenders offer one-time financing with set amount and repayment schedule. Personal line of credit, on the other hand, allows you to cover expenses with a set limit and revolving balance. While this type offers more flexibility than the previous one, it might cause problems if you fail to pay the debt on time.