Payday loans are special loans that are small in amount but quickly processed to benefit their recipients. It is normally known as short term cash loans that are made available to working consumers who require a little extra finance to tie them over till their next payday.

Scope of borrowing

It can be secured through many qualified and approved payday loan providers in the market that can offer small to medium loans to working consumers who meet the borrowing criteria laid down by the authorities. Different states apply slightly different borrowing criteria according to the borrowing legislature of that state. Consumers residing in one state cannot apply for finance from another state. There are a variety of differing terms and conditions on loans by different states.

Preference

Payday loans are preferred over many other types of loans as they are quick and easy to procure. These loans are useful to working consumers who may experience some financial tightness in a particular month although they are generating a fixed or healthy income. Consumers may experience an extra cash requirement when they need to make car repairs or home renovations; these needful payments may exceed the budget which brings one to consider Finance. Procurement

Such loans can be procured through the right sources in the market as there are many approved loan providers who are direct loan lenders. This means that the loan providers have the necessary funds and resources to process and pay out the desired loan amount quickly without having to revert to third party lenders.

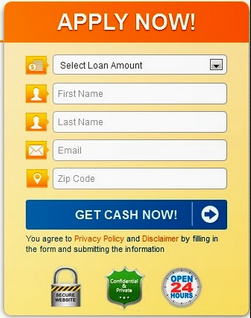

The loan process is easy and simple with little hassle. Borrowers need not fill in copies of tedious application forms with stacks of documents accompanying their application. The computerized system is able to approve or reject any payday loan application within seconds.